Trust Across America’s FACTS® Framework: Fast Facts

Trust Across America’s FACTS® Framework: Fast Facts

(a summary of our 10th anniversary 46-page report “Trust & Integrity in Corporate America 2018” )

Introduction: Developed by a cross-silo multidisciplinary team, and in the wake of the financial crisis in 2008, the Framework evolved with the goal of creating a long-term model to reduce corporate risk and maximize profitability by measuring trust. With the assistance of professionals from leadership, compliance and ethics, governance, accounting, finance, HR, consulting, corporate social responsibility, ESG, sustainability, and other disciplines, FACTS® was finalized in 2010.

Methodology: Now in its 9th year, Trust Across America performs an independent annual analysis using its rigorous and unique FACTS® Framework. Companies do not participate, nor do they know they are being analyzed.

How we define trust: A byproduct of strong core values that are practiced and reinforced daily.

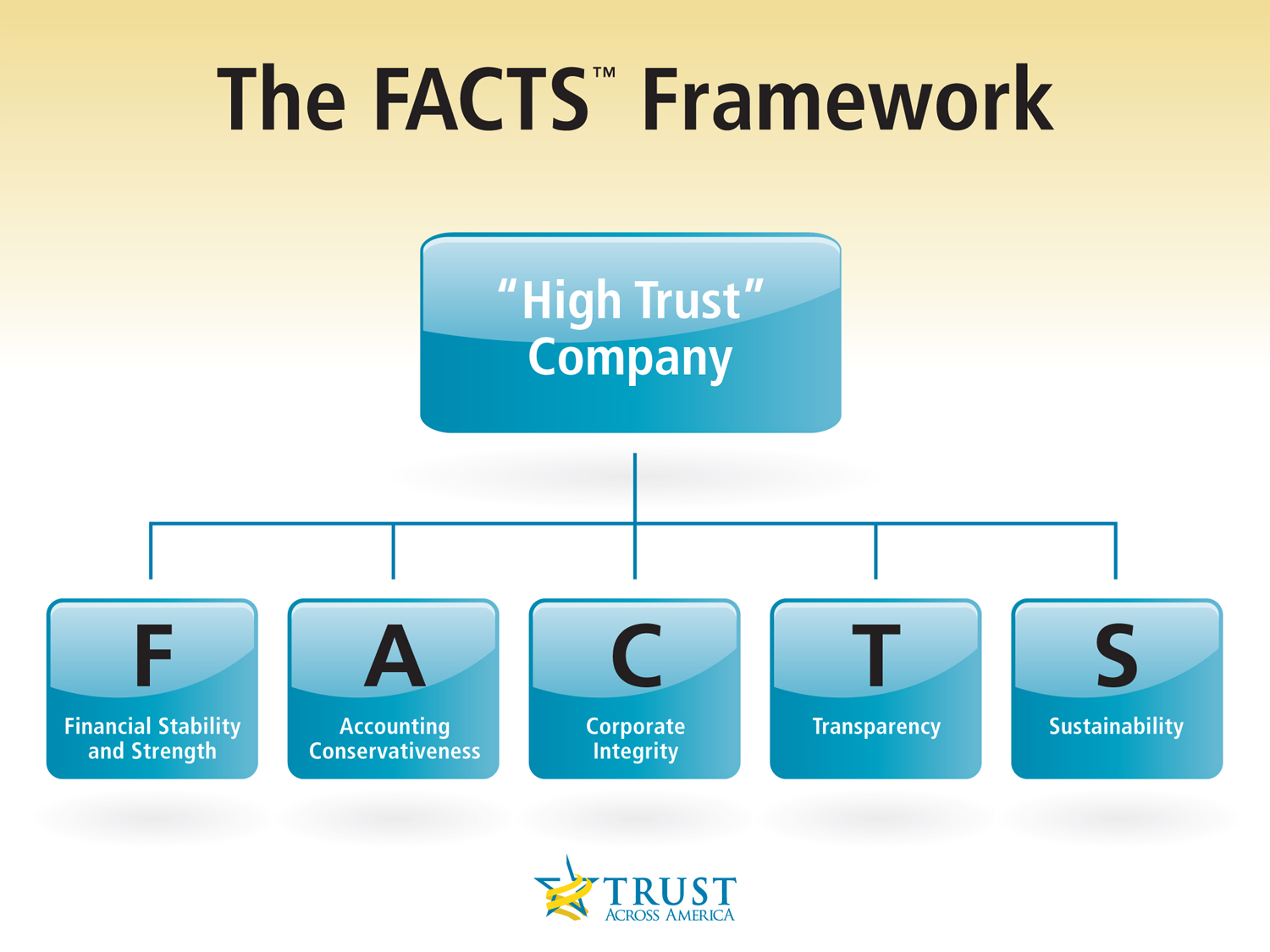

The FACTS® Framework:

The Framework incorporates proprietary metrics and measures the trust “worthiness” of public companies based on five equally weighted indicators that form the FACTS® acronym: Financial stability, Accounting Conservativeness, Corporate Integrity, Transparency & Sustainability. Additional screens may include but are not limited to fines and violations, percentage of women on the board, CEO pay ratios and tenure, employee reviews and news. Our analysis has never identified a “perfect” company. In fact, on our 1-100 scale, it is unusual for a company to score above an 80%. In 2018, 103 companies in the Russell 1000 scored a 70% or above. The full list is provided in our research report.

Measuring Outcomes and Impacts: On average, and over the long-term, the “Top 10″ most trustworthy public companies have outperformed the S&P 500 by over 25% since inception. In each of the six full years, the selected group has had a higher return than the S&P 500. (June, 2018)

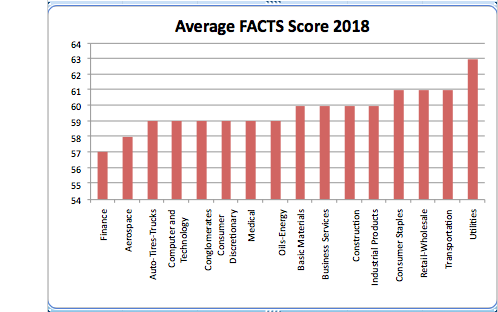

Sector analysis: FACTS® data is sorted by sector and the following chart represents the sector rankings for the Russell 1000 for 2018. FACTS® uses Zacks Investment Research that divides date into 16 sectors. Others like S&P and Morningstar sometimes place companies in different sectors. For example, Zacks financial sector includes banks, insurance companies, REITS and brokerage firms, to name just a few.

Comparability: FACTS is a unique proprietary model measuring the trustworthiness of America’s largest (2000+) public companies. Other measurements of trust tend to be silo specific and qualitative, while FACTS® is quantitative and objective.

For more information: Barbara Brooks Kimmel, CEO & Cofounder

Barbara@trustacrossamerica.com

Copyright © 2018, Next Decade, Inc.

Recent Comments