by Barbara Brooks Kimmel

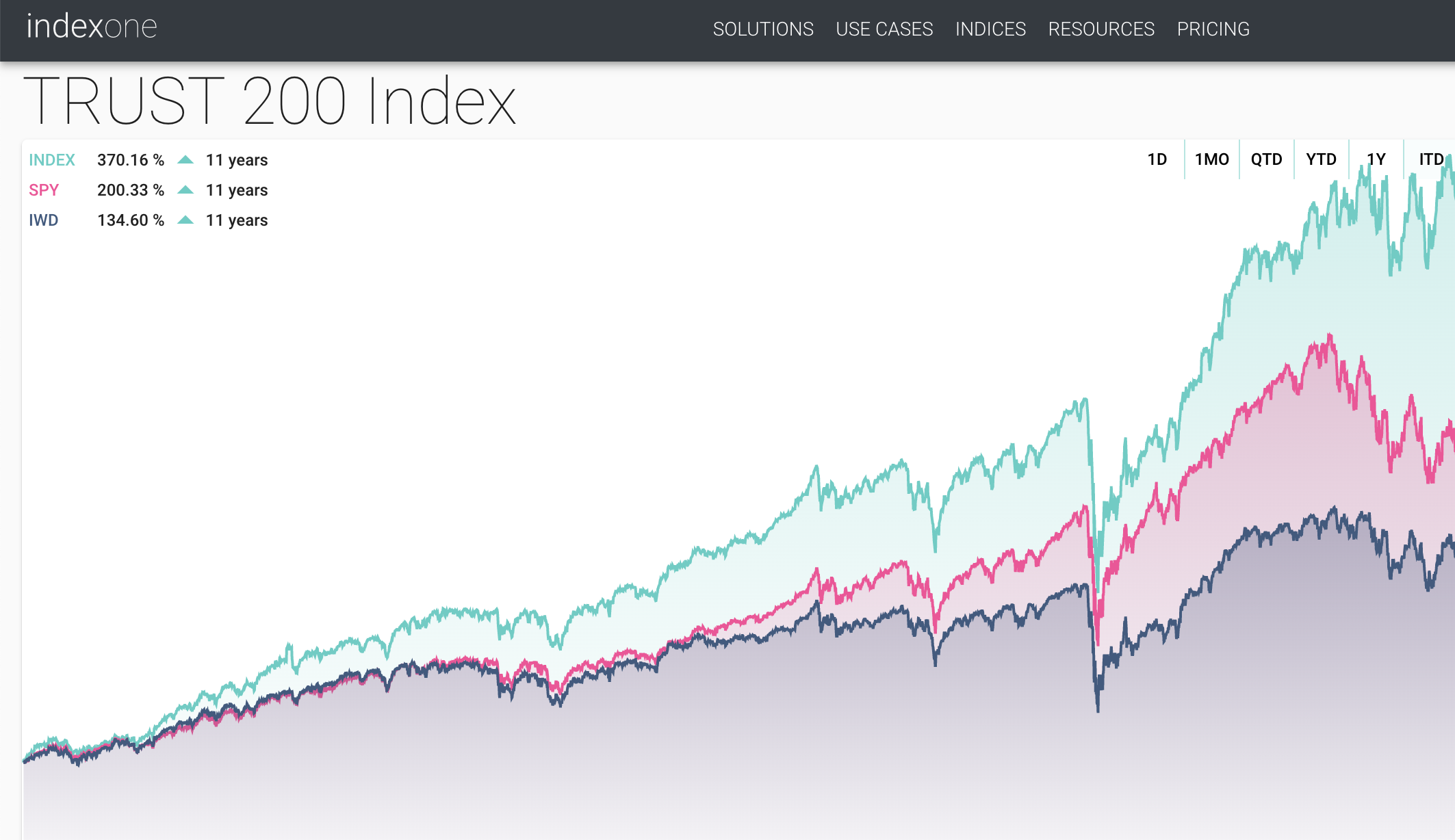

Now that the year has drawn to a close and a new one has begun, I am reminded of the similarities between the 2008 financial crisis and the market instability of 2022. In fact as Reuters recently reported, Wall Street ended the year with the biggest annual drop since 2008, as the global stock and bond markets shed more than $30 trillion dollars. And sadly as we head into 2023, the prevailing mood among both investors and the general public is fear, and fear is the opposite of trust. The chart below shows the outcome when trust replaces fear.

What lessons, if any, has the investment community learned over the past 14 years?

Consider these:

- Ten+ years past the 2008 financial crisis, little has changed to increase investor confidence in the ethical decision making practices of business leaders and the titans of Wall Street.

- It is not valuation, liquidity, or profits that keeps many investors on the sidelines. It is a lack of trust.

- We continue to see high profile business scandals, accounting coverups, out of touch compensation practices and a leveraged lending fiasco with no end in sight.

- Many investment professionals and investors are choosing to take their guidance from the wrong teachers who may be placing their own short-term interests first.

How do we learn from these lessons and move forward as we head into 2023? The solution is very simple. The industry must turn its attention to building trust.

Trustworthy companies outperform their peers with less risk

In the wake of the financial crisis I started a program called Trust Across America with the mission of helping organizations build trust. One of our first challenges was to make the “business case for trust” having been told that without proving that trust works, business leaders would ignore us. With the assistance of dozens of cross silo professionals, in 2012 we finalized a model to evaluate the trustworthiness of public companies, incorporating quantifiable metrics and data and named it the FACTS® Framework, an acronym that includes five drivers or indicators of trustworthy business behavior. They are:

- Financial stability

- Accounting conservativeness

- Corporate governance

- Transparency

- Sustainability

When we began this research over ten years ago we were also told that a ten year tracked record would be required before serious consideration could be given to our model. Having recently reached that milestone, in June 2022 we retained Index One, a global index creation firm based in London to evaluate our FACTS® Framework versus major US indexes.” The results:

- The top 50 FACTS® companies outperformed IWD by 47%, 15.46% vs.10.51%

- The top 100 FACTS® companies outperformed IWD by 52.9%, 16.07% vs. 10.51% for IWD

- Index One also performed the same analysis using the SPDR S&P 500 (SPY) ETF. 16.07% (50 companies) and 15.46% (100 companies) respectively vs. 15.27% for SPY.

Further evidence of the outperformance of trustworthy companies is contained in this ten+ year study published in November 2021, and covered in Investor’s Daily in May 2022. It is, by order of magnitude, the most comprehensive and data driven analysis available regarding the trustworthiness of public companies. It speaks to both the public and the financial industry’s understanding of trust, supports trust based investment decision making and enables targeted and simplified trust portfolio construction.

Vast amounts of money remain parked in low yielding money market accounts and other underperforming investments. By delivering a time tested and “beyond reproach” strategy to investors combining the key drivers of corporate trustworthiness, Trust Based Investing can become the solution that both the industry and the public has been seeking.

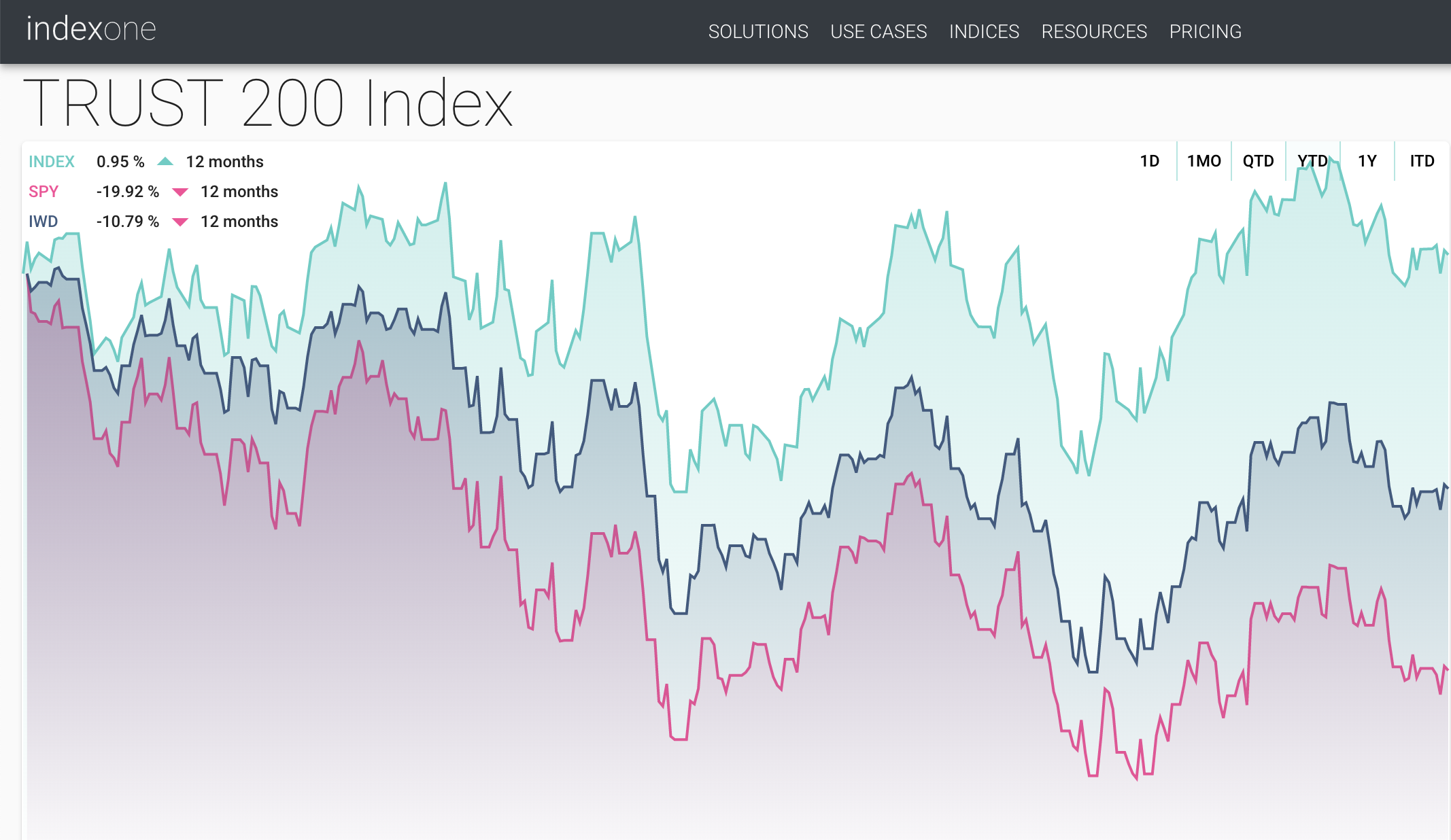

Some may be curious as to how our Trust Index performed in 2022. We finished up close to 1% in a year when the S&P 500 declined almost 20%.

Don’t Take Our Word for the Importance of Trust

Building a trustworthy business will improve a company’s profitability and organizational sustainability. A growing body of evidence shows increasing correlation between trustworthiness and superior financial performance. Over the past decade, a series of qualitative and quantitative studies have built a strong case for senior business leaders to make stakeholder trust building a high priority. While none of these studies are perfect, their results are becoming increasingly difficult to ignore.

- Research shows that 30% of a company’s value is at risk where trust is broken with the public and external stakeholders. Those CEOs who have a proactive approach to crisis planning view simulation training and drills as an investment. They also see it as a way to test and build the trust and confidence of their teams. It hones and develops leadership and communication skills, builds coherence and cross-functional support. *McKinsey & Company research in Connect: How companies succeed by engaging radically with society – 2015 – John Browne, Robin Nuttall, Tommy Stadlen

- According to the proprietary FACTS® Framework research conducted by Trust Across America-Trust Around the World, on average, and over the long-term, the “Top 10″ most trustworthy public companies have significantly outperformed the S&P 500 over 10 years, 5 years and 3 years.

- Only 7 percent of Americans believe that major company CEOs have high ethical standards, and only 9 percent have a very favorable opinion of major companies. Only 42 percent Americans trust major companies to behave ethically, down from 47 percent last year. Public Affairs Council, 2018

- Today, only a minority of millennials believe businesses behave ethically (48 percent vs 65 percent in 2017) and that business leaders are committed to helping improve society (47 percent vs 62 percent in 2017). Deloitte Millenial Survey 2018

- In an innovation survey published by PriceWaterhouseCoopers in the early 2000s, trust was identified as a key characteristic of innovative companies

In conclusion

The business case for both trust and Trust Based Investing is being made. Trust Based Investing provides the following:

- Companies have proven through a rigorous analysis that they are trustworthy and represent lower investment risk.

- Investors can be assured that both business and investment decisions are being made ethically.

- The most trustworthy companies have stable and strong investment returns.

- A virtuous cycle is created. As investment money flows into the hands of these companies, other companies will want to follow suit and become more trustworthy.

In the words of Warren Bennis “Trust is the lubrication that makes it possible for organizations to work.”

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

To obtain more information please visit the contact page on our website or

Recent Comments