(A Historical and Current Perspective)

I recently came across a powerful blog post written by Jason Tapp (www.truaimconsulting.com) called BUILDING THE CASE FOR BUILDING TRUST. With Jason’s permission, the blog is reposted below, followed by some further research performed by Trust Across America (www.trustacrossamerica.com) that supports Jason’s case.

Trust is thought of as a form of social capital, which can be considered the emotional or psychological equivalent of financial capital. When trust is abundant and we invest our time and efforts in continually building it, we can gain great emotional and financial returns. However, when trust and confidence are nonexistent and our relationships are emotionally bankrupt, the results can be catastrophic.

Francis Fukuyama put it best after examining the differences in economic prosperity among different cultures. He concluded, “A nation’s well-being, as well as its ability to compete, is conditioned by a single, pervasive cultural characteristic: the level of trust inherent in the society.” In our current global economic reality, he believes that “social capital represented by trust will be as important as physical capital.”Thomas L. Friedman in his book The World Is Flat put it this way; “Without Trust, there is no open society, because there are not enough police to patrol every opening in an open society. Without trust, there can also be no flat world, because it is trust that allows us to take down walls, remove barriers, and eliminate friction at borders.”

Intuitively, we know that trust is required to have successful relationships, and successful relationships are required to have successful businesses. In any business relationship, we have to have some level of confidence that others will deliver on their business agreements and commitments. If we have no confidence in a potential business relationship we are not likely to enter into it. When it comes to our businesses and our money, none of us wants to take a business risk with a person or organization that has no credibility or track record of results.

Beyond the intuitive level, there is well-researched hard evidence that high trust relationships are good for business. For example, the 2009 Edelman Trust Barometer research www.edelman.com showed that for low trust businesses, 77% of people refused to buy their products and services, 72% criticized them to a friend or colleague, and 34% shared negative opinions and experiences online. In high trust businesses 91% chose to buy their products and services, 76% recommended them to a friend or colleague, 55% paid a premium for their products and services, and 42% shared positive experiences/opinions online. Obviously these customer actions would have a huge impact on the bottom line. In the WorkUSA 2002 study the Total Return to Shareholders (TRS) over a three year time period was 20% for high trust companies and only 7% for low trust companies, an increase of about 300%.

Trust also affects employee engagement. According to the 2008 Global Recognition Study, 35% of employees in low trust companies were engaged as compared to 65% in high trust companies. If you add a culture of appreciation and recognition to the equation, engagement jumps to 63% for low trust companies and an amazing 91% for high trust companies with appreciation.

Trust is related to positive results in areas other than business. Researchers from the Consortium on Chicago School Research reported on their investigations of Chicago school reform during the 1990s. They found that in schools where teachers didn’t trust one another the schools had either flat or declining test scores, and both teachers and students were less satisfied with their experiences. On the other hand, in schools where trust and cooperative efforts among adults were strong, scores were improving, students felt teachers cared about them, and they felt more challenged academically.

Kurt Dirks of Washington University examined the effect of NCAA basketball players’ trust in their leader on team performance. He found that in the two teams trusting their coach the most, one was ranked top in the country for much of the season and the other played in the national championship. On the other hand, the team with the lowest trust in their coach lost 90% of their games and the coach was fired at season’s end.

The evidence is undeniable. Individuals and organizations who invest energy in successfully cultivating the social capital dimensions of trust and confidence with their constituents will reap the emotional, psychological, and financial benefits of their efforts. (end of Jason’s post.)

Under the theory of “What Can be Measured Can be Managed,” creating measurable standards of trust would appear to be the next logical step in building a business case for building trust. According to Frank Sonnenberg, author of Managing With a Conscience,

In the twentieth century, a company measured success by the number of tangible assets (such as property, plant, and equipment) it posted on its balance sheet. In the Information Age, however, intangible assets rule the day. Intangible assets such as trust, creativity, speed, relationships, reputation, loyalty, employee commitment, brand identity, and the ability to adapt to change determine success.

Why track company performance based on trustworthy behavior? Because trust is an inherent element of optimism that buoys any economy, and companies that understand the correlation between trust and sustainable business create greater value for all stakeholders, in addition to “doing the right thing.”

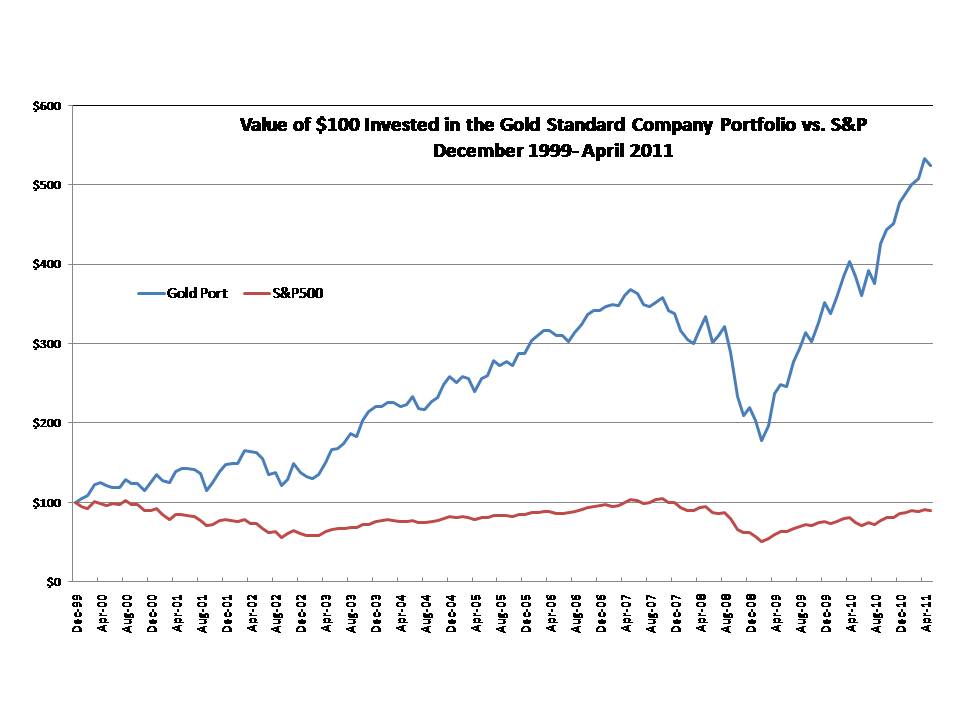

Trust Across America’s proprietary research confirms that the most trustworthy companies provide long-term benefits to all stakeholders, including shareholders. In November, 2010, our data identified 59 companies that met our benchmark standard for trustworthy business behavior. The chart below is a graphic representation of the performance of the “Gold 59” from 1999- April 2011 vs. the S&P 500.

This group contains many “household” names like Aflac, Fed Ex, Lexmark and Cigna. Others are not as well known- Albemarle, Praxair, Ecolab and Lubrizol, which was acquired by Berkshire Hathaway earlier this year. But whether well known or unknown, they all share a common characteristic. They have integrated a culture of trustworthy business that benefits all stakeholders, including shareholders- representing the “best in breed” of sustainable business.

Charles Green, the Founder of Trusted Advisor Associates, sums up the case for building trust in business as follows. “Reliance solely on economic and market-based tools works for mono-focus and short-terms; by contrast, trust scales as a management tool. More deeply, trust itself is also built on extensive relationships over time. It is a natural way of doing business for those who believe in sustainability.”

Do you want to help us build the case for building trust?

Contact Barbara Kimmel at barbara@trustacrossamerica.com or Jason Tapp at jason@trueaimconsulting.com

Recent Comments