(A condensed version of this article first appeared on The FCPA Blog)

Recently, the newly appointed CEO of Novartis, Vas Narasimhan, announced that he would be linking employee bonuses to ethics as part of a strategy to rebuild the company’s reputation. Specifics of the scoring system were not divulged. This raises some interesting questions in the trust, ethics and compliance community. Among them, is it ethical to pay people to act ethically or is it a form of bribery? Will these bonuses elevate ethical behavior? What is the minimum “acceptable” behavioral standard to receive a bonus? We asked Trust Across America’s 12-member Trust Council to weigh in. Some of their best answers from both a macro and micro perspective, are provided below.

Ethics is a Company Wide Issue

At Datron, we spend a lot of time in the FCPA world as over 90% of our business is conducted outside the US. We find that ethics is a company wide issue that encompasses not only your employees but also any organization that represents us in the marketplace. We have not taken the route of rewarding ethical behavior at the employee level. We spend the money on training, both in the compliance area and in the “servant” leadership area to ensure that everyone understands the company mission, purpose and how our behaviors (values) are reflected in the work we do. In our multi-cultural company with over 80 representatives around the world we take compliance to all entities that interface with our customers at any level. This means that our annual FCPA training is required and annual anti-bribery statements are completed by both employees and our representative companies. In addition we require all of our representatives to hold current Trace International certifications. If these items are not completed as required we don’t do business with that organization and don’t let our employee interface with the customer.

In general I would recommend that leaders know what would work best for their organizations. I personally would not take the approach Novartis has taken just because paying money for a required behavior is too much like a bribe and I believe it sends the wrong message to the organization. It also says that it is ok to act unethically we just won’t provide you a bonus if you do. I think requiring behavior in accordance with the company values is a better long-term solution.

I believe that a focus on culture, understanding why it is important for the organization to conduct itself in accordance with it’s core values and spending training dollars to ensure this each and every day is a better investment than providing an annual bonus award. Art Barter

Influencing Human Behavior

This approach is a good idea for Novartis. We can’t change human nature—there will always be some unethical people. But we can influence human behavior. We influence human behavior through many means: education and training, personal examples and role models, good leadership, shared norms and values, rewards and punishments, and more. Good companies reward (or punish) employees with scoring systems for both achieving goals (results) and “how” those goals are achieved. Scoring a 1 on values and behavior at Novartis (1 = below expectations) makes an employee ineligible to receive a bonus and likely signals they may face demotion or termination. It is a realistic way to grab people’s attention that unethical behavior will no longer be tolerated at this firm. Bob Vanourek

Systematizing Ethical Practices

I applaud Novartis’ efforts to encourage and systematize ethical behavior. Behaving ethically should be the “ticket of admission” for even having a job, but many organizations don’t view it that way. Novartis is taking proactive steps to enforce consequences for salespeople who don’t meet expectations. Randy Conley

Innovation is Key

To determine the best ways to make progress on the trust, transparency and ethics road we have to innovate. To develop proven, repeatable and scalable strategies we all have to be bold enough to try. Novartis is trying. We don’t know the context or risk appetite they are working from so it is hard to objectively review their strategy. To innovate well we have to accept failure and partial successes, learn, pivot and go at it again. The fact that organizations are trying is, in my mind, the thing of value. They will engage in many critical conversations around this project and that dialogue with their employees, partners and board is priceless in the fight for ethics. Deb Krizmanich

Discussing Ethics

Ethical performance — good or bad — is an intrinsic aspect of organizational culture, While company value statements, codes of conduct and compliance training are essential components of an ethical culture, even more important is how organizations react to ethical dilemmas and lapses. When discussions about ethics are taboo, and individuals are rewarded for unethically achieved results, the culture quickly adapts to this reality without regard to official policy. In this respect, Novartis is on the right track by explicitly withholding rewards for employees who behave unethically. Even more telling will be whether discussion of ethics is normalized and unethical behaviors consistently derail careers at the company. Barton Alexander

Payments for Behaving Ethically

There is something prima facie anti-ethical about paying people money to behave ethically. If you have to be paid to be ethical, you’re not. And by reducing ethics to behavioral inducements, the system devalues the ethicality of all actions, regardless of their objective desirability. This reduces ethics to the category of compliance and sales quotas. Charles H. Green

The Devil is in the Details

Whether the Novartis plan is a good idea to resolve the ethical dry rot is debatable. The devil is in the details, but I would raise a caution flag. Essentially they are saying that meeting expectations or being a role model for ethical behavior will earn employees extra pay, while not meeting expectations means you get no extra pay, and it could lead to termination. I also do not agree that bringing in Klaus Moosmayer from Siemens to be the ethics tsar is going to make up for poor leadership at the top. Bob Whipple

A further Internet search of the Novartis bonus “plan” revealed the following “anonymous” comment:

This has been in place for over two years. Probably just touting this in the news because of all the recent violations. Reps don’t get an additional bonus. They have money withheld from each bonus period and if their manager sees fit and gives them a good rating, they may or may not get all the money back. So Novartis actually takes money and holds it for a year. Some reps get back more but a lot will actually get back less. The kicker is, they have to still be employed to get that money and it’s only paid out once a year and it’s supposed to be about values and behaviors but it’s still tied to sales.

The Trust Council jury is split with regard to the ethics of ethics bonuses. To be meaningful ethics and trust must remain a top-down strategy built from the inside out, and only then will they have a long-term impact on organizational reputation.

Trust Across America-Trust Around the World’s Trust Council is an invitation-only advisory group comprised of global business leaders and consultants from a broad cross section of industries and functions who are rotated through membership in our Trust Alliance. The Council serves for twelve months.

Barbara Brooks Kimmel is an award-winning communications executive and the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. A former consultant to McKinsey and many Fortune 500 CEOs and their firms, Barbara also runs the world’s largest global Trust Alliance, and is the editor of the award-winning TRUST INC. book series and TRUST! Magazine. In 2012 she was named one of “25 Women who are Changing the World” by Good Business International, and in 2017 she became a Fellow of the Governance & Accountability Institute. Barbara holds a BA in International Affairs and an MBA. Don’t forget to TAP into Trust!

For more information contact barbara@trustacrossamerica.com

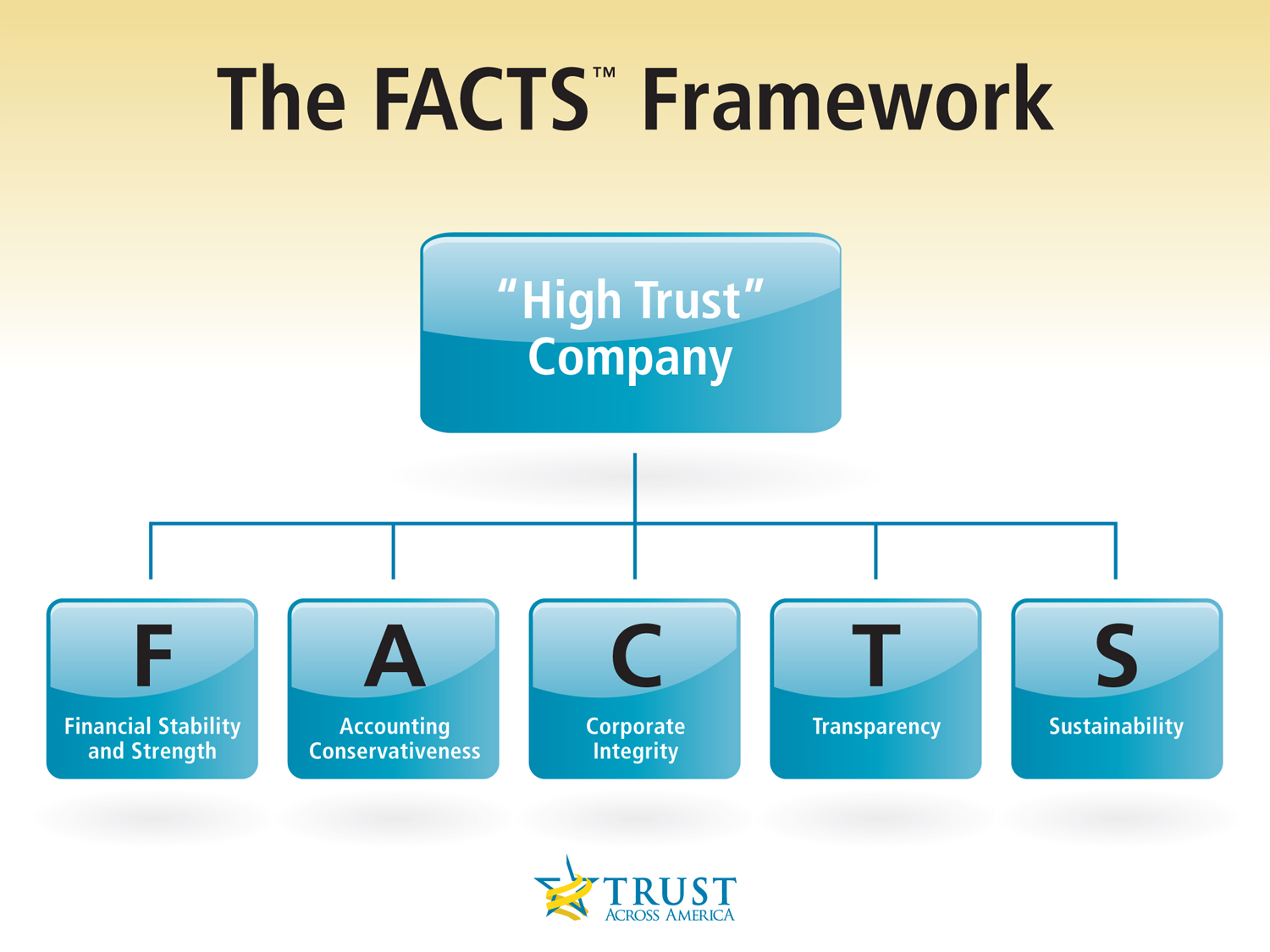

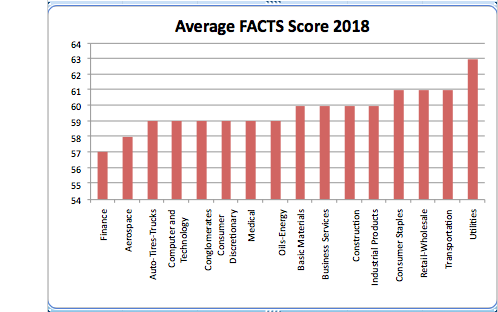

Trust Across America’s FACTS® Framework: Fast Facts

Trust Across America’s FACTS® Framework: Fast Facts

Recent Comments