Many models of (un)ethical decision making assume that people decide rationally and are, in principle, able to evaluate their decisions from a moral point of view. However, people might behave unethically without being aware of it. They are ethically blind.

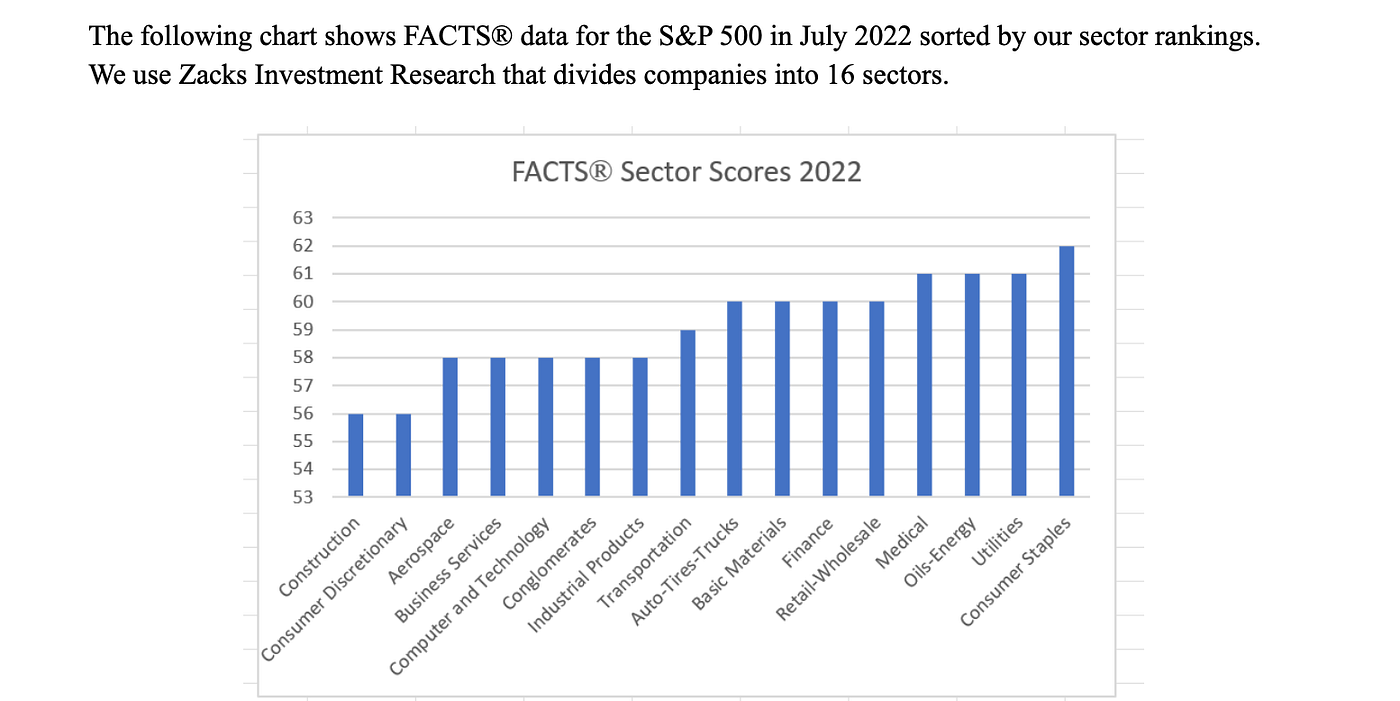

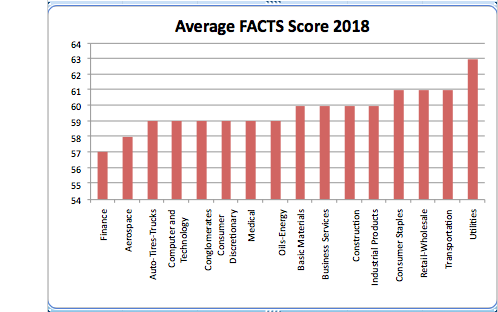

As organizations are comprised of individuals, Ethical Blindness naturally extends into the workplace. Some business sectors appear to be more ethically blind than others, and this creates enormous enterprise risk.

More on our Framework here.

Ethical blindness can be corrected, but only if leaders choose to be “tuned in” to the warning signs described below:

- The Board of Directors has not established policies or procedures to elevate ethical and trustworthy behavior within their own team, nor with their internal and external stakeholders.

- Leaders, unless they are ethically “aware” by nature, are not proactive about elevating trust or ethics as there is no mandate to do so. When a crisis occurs, the “fix” follows a common “external facing” script involving a costly and unnecessary PR campaign. A few years ago Wells Fargo ran a “building trust” television commercial providing a timely example of bad PR. Meanwhile internally, it was (and continues to be) “business as usual.”

- Discussions of short term gains and cost cutting dominate most group meetings. The pressure to perform is intense and the language used is very strong.

- The Legal and Compliance departments are large and growing faster than any other function.

- The organizational culture is a mystery. No clear “ownership” of ethical or trustworthy business practices or decision-making exist. Nobody, including leadership, wants to take ownership for fear of finding out.

- Discussions/training on ethics and trust rarely occur and when they do, they are lead by either the compliance or legal department and focus on rules and risk minimization, not ethics and trust.

- Ethical considerations/testing are not part of the hiring process and fear is widespread among employees.

Is Ethical Blindness at the organizational level fixable? Absolutely. But the first order of business requires leadership acknowledgement and commitment to elevating organizational trust and ethics.

These 12 Principles called TAP, were developed over the course of a year by a group of ethics and trust experts who comprise our Trust Alliance. They should serve as a great starting point for not only a discussion but a clear roadmap to eradicating Ethical Blindness. As a recent TAP commenter said:

“An environment /culture that operates within this ethos sounds like an awesome place to me, I would work there tomorrow if I knew where to look for it.”

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others. For more information contact barbara@trustacrossamerica.com

Copyright © 2023, Next Decade, Inc.

Recent Comments