Ever since the financial crisis, it’s not uncommon to read articles and studies about trust in banking and whether trust is “up” or “down.” In the past year alone:

- Ernst & Young reports consumer trust in banks is diminishing. September 2016

- International Banker claims that trust is often found wanting in today’s banking relationships. December 2016

- Edelman reports in their 2017 Trust Barometer that in the United States 60 percent of financial institutions bounded forward (in trust) six percentage points from 2016. March 2017

- And according to The Hill, almost a decade later, public trust in financial institutions remains stubbornly low. April 2017

So is trust in banking up or down? Some of the confusion stems from a lack of definitional clarity. Without a clear(er) understanding of what “trust in banking” means, the entire sector finds itself painted with one broad brushstroke, the reading public is left in an an ever escalating state of confusion, and elevating organizational trust becomes all the more challenging.

Trust? What are we trusting banks to do, or not do? Safeguard our money, earn a good return for shareholders, protect our personal data, treat employees well, provide good customer service, or all of the aforementioned?

Banking? Can global investment banks, regional banks, and/or a local savings and loans be grouped together when discussing trust in banking? Should they be?

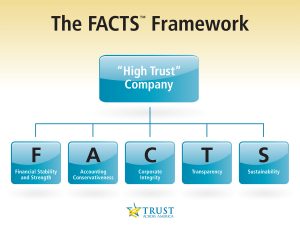

For seven years Trust Across America has been researching the trustworthiness and integrity of America’s largest 1500 public companies via our proprietary FACTS® Framework.

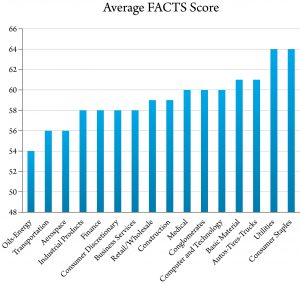

This is, by order of magnitude, the largest ongoing study ever conducted on trustworthiness and integrity at the individual corporate level. Our 2017 data concludes that the finance sector remains among the lowest in trust, with an average score of 58.

But our data also tells a more holistic and detailed story, and one that places us in a unique position to discuss trust in the banking industry. Industry is NOT destiny and those more trustworthy financial institutions suffer at the hands of their less trustworthy colleagues. And the headlines above only serve to reinforce this fact.

It’s important to give credit to companies who have earned the trust of a broad range of stakeholders. Understanding that no company is perfect, the following is a list of some of the “banks” that score a “70” or above (on a scale of 1 to 100) according to our 2017 FACTS ® Framework research. Scores in the finance sector range from 40 to 77.

- Morgan Stanley

- Goldman Sachs

- KeyCorp

- Commerce Bancshares

- US Bancorp

- Bank of America

- JP Morgan Chase

Headlines don’t always report the “full” story nor do articles and studies regularly or consistently define the meaning of trust. Trust in banking isn’t necessarily “up” or “down.” The level of trustworthiness or integrity of a specific company is determined by how well leadership defines its corporate culture, and understands and embraces the value of trust in meeting the needs of every stakeholder group. Our study continues to point in the direction that trust is not only a measurable business strategy and a business differentiator, but also a direct route to long-term profitability.

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. She also runs the world’s largest global Trust Alliance and is the editor of the award winning TRUST INC. book series. In 2012 she was named one of “25 Women who are Changing the World” by Good Business International, and in 2017 a Fellow of the Governance & Accountability Institute.

Purchase our books at this link

Purchase our books at this link

For updates on our Corporate Integrity Monitor, please join our mailing list. To be among the first to review our research and more fully engage in elevating organizational trust, please consider membership in our vetted Trust Alliance.

Copyright 2017, Next Decade, Inc.

Recent Comments