How often has the word “trust” been mentioned in the news this past week?

How often has the word “trust” been mentioned in the news this past week?

Trust in Google, Facebook, the Supreme Court, science and even the MLB. It seems that by the day, trust “talk” gains in popularity. There is no arguing that trust is a hot topic from the mountains of Davos all the way down to Wall Street.

Unfortunately, most news articles ignore the interpersonal and internal nature of trust in organizations (the ones that are difficult to monetize), instead focusing on trust “talk” and “work arounds.” We read about trust and data security, trust and sustainability, brand trust, and one of my favorites, Natural Language Processing (NLP) measures of trust. This not only adds to the public’s misperception of what trust is, and what it is not, but it also dilutes the importance of the role trust plays in building principled and healthy organizations; the ones where people want to work.

This past week the global communications firm Edelman turned the discussion of trust to who owns it within the corporate structure. Their conclusion? The CIO. “The CIO in Focus study by Edelman reveals that CIOs are under increasing pressure to help safeguard not only a company’s data but also its corporate reputation and trust.”

What better opportunity to engage the members of our Trust Council and ask them the same question: “Who owns trust?”

According to Bart Alexander of Alexander & Associates, it’s certainly not the CIO, although that person does play a role.

Chief Information Officers certainly do not “own” trust, nor are they the sole “guardians of trust.” All C-suite members play significant roles in setting corporate culture including the norms and behaviors that foster trust. In that respect, CIOs share the same responsibility as their C-suite peers.

At the same time, CIOs do play at least two unique and key roles in building and guarding trust., First, CIOs determine data strategy that determines the level of respect for privacy and security. And additionally, CIOs are business partners across the enterprise in both ongoing operations and innovation, giving them a direct view of the and influence on the value being placed on integrity and respect now and down the road.

Randy Conley of Ken Blanchard supported Bart’s position, taking the response one step further:

The person at the top (CEO, President, etc.) has a greater obligation to be the guardian of organizational trust.

Delegating responsibility to the CIO, “Chief Trust Officer,” or any other person or team, signals that trust is just another corporate duty that can be compartmentalized and managed in a silo. Saying the CIO is the guardian of organizational trust is a myopic view on the scope and importance of organizational trust. Corporate governance, brand reputation, customer experience, financial integrity, environmental responsibility, and community stewardship are among many key areas that impact stakeholder trust in an organization. Everyone needs to shoulder responsibility for building trust if an organization wants to achieve the quadruple bottom-line (employer of choice, provider of choice, investment of choice, environmental steward).

Bob Vanourek a former Fortune 500 CEO agreed:

Glad to see CIOs need to “safeguard” and “play a crucial role,” or even be the “Guardians” of trust. But trust-building among all stakeholders is so critical that it must not be delegated. Enlist the CIO, CHO, CFO, and more. But only the CEO should “own” trust.

Bob Whipple of Leadergrow also agrees that the ownership of trust is the responsibility of everyone in the organization:

The short answer is “everyone,” since trust can be created or destroyed by anyone in an organization. In reality, the mandate to create, maintain, enhance, and repair trust gets more important as you go upward in an organization. The most senior leaders have the responsibility for setting the tone for everything that happens in their organization. If the level of trust throughout the layers is inadequate, the senior-most leader needs to take a good long look in the mirror to see the culprit.

Apparently, engaging subject matter experts who know trust best also provides the most coherent answers to questions like “Who owns trust?”

In summary, trust ownership cannot be delegated to a CIO or anyone else, and it will only be effective when:

- Leaders acknowledge that trust starts with them, and is always constructed from the inside out

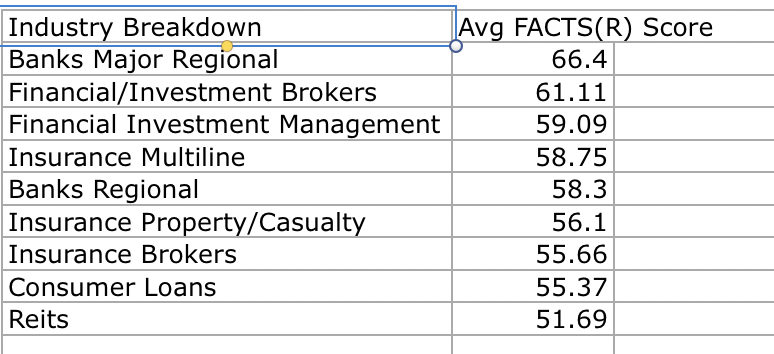

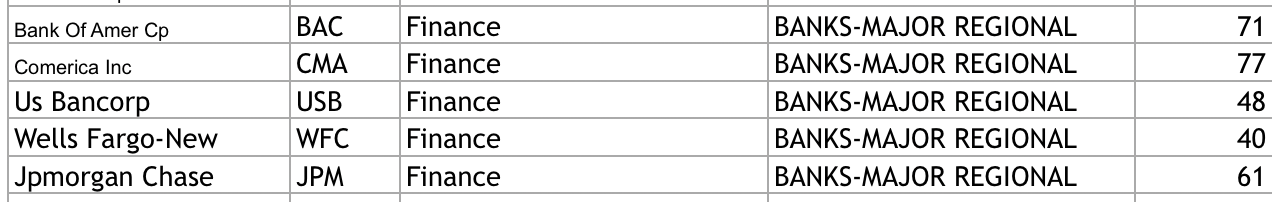

- The right tools are used to identify trust weaknesses and strengths

- Team members are free to discuss trust through open dialogue

- Trust weaknesses are mended and strengths are celebrated

We call this process AIM Towards Trust... Acknowledge, Identify, Mend and it’s been used successfully in teams and organizations of all sizes, shapes and colors; but only when leaders intentionally choose to build trust into their corporate culture AND don’t attempt to delegate it.

Falling prey to quick fix solutions for elevating trust should be avoided. So should news coverage that misdefines and misplaces trust including discussions of brand trust, data trust, NLP trust, and check-the-box trust. Trust is always internal and interpersonal. These “perception of trust” work arounds may be money-makers for those who promote them, but as far as ensuring sustainable trust within an organization, there is only one route, and it’s not by having the CIO “own it.”

Thanks Trust Council members for your contributions to this article. Would you like to serve on our Council? The place to begin is by joining our Trust Alliance.

Barbara Brooks Kimmel is the Founder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. For more information on how to build authentic trust, contact her at barbara@trustacrossamerica.com

Copyright 2019, Next Decade, Inc.

Click here to read Edelman’s Press Release. www.prnewswire.com/news-releases/cios-emerge-as-new-guardians-of-corporate-trust-300942787.html

Purchase our books at this link

Purchase our books at this link

Recent Comments