Archive

Posts Tagged ‘Warren Buffett’

Every year at this time I start feeling like a kid in a candy shop!

Why? Not only is Spring right around the corner, but so is the release of our annual Most Trustworthy Public Companies, a list we have been publishing for the past three years.

It’s time to starting poring over massive Excel spread sheets to identify those companies rising to the top of our FACTS Framework, or said another way, those companies that crush their competitors on all indicators of trustworthy business behavior. Who will these companies be for 2013? We’ll let you know on April 15th!

What if I told you that trustworthy companies “beat the Street” by over 100%?

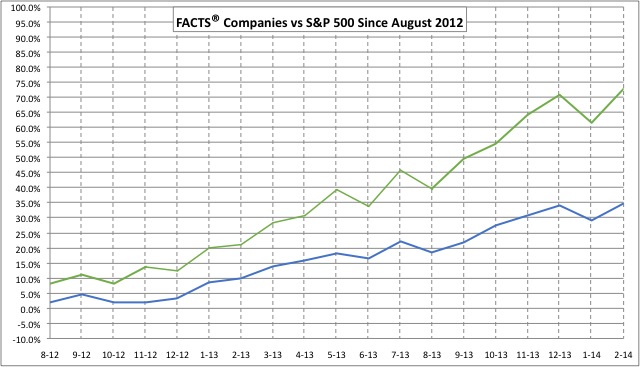

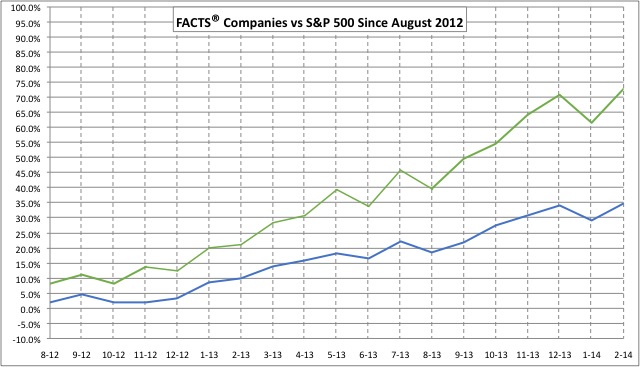

This picture tells its own story. FACTS is represented by the green line on top and the vertical axis is the percentage change in stock price. From August 2012 through February 2014, the S&P 500 is up 34.8% not including dividends, and our FACTS Model returns are 72.9% not including our dividends. That’s slightly more than 2X the market.

FACTS (an acronym) selects companies on the basis of their Financial stability, Accounting quality, Corporate integrity, Transparency, and Sustainability. See link

But why take our word for the Business Case for Trust? Here’s some additional expert input from Gallup, The Washington Post, Edelman, Harvard, The Economist, Fortune and Forbes.

And finally, for those of you who still aren’t convinced, you can read a heartwarming story about Warren Buffet, friendship and trust. This is a link to the book referenced in the article.

Please send me a note at barbara@trustacrossamerica.com if you have any questions or comments about this post.

If not, see you on April 15th when our 2013 Most Trustworthy Public Companies is released.

Barbara Brooks Kimmel, barbara kimmel, Edelman, FACTS(R), Forbes, Fortune, Gallup, Harvard, The Economist, trust across america, trust in business, Trust Inc. Strategies for Building Your Company's Most Valuable Asset, trustworthy behavior, Warren Buffett, Washington Post

Does Trustworthy Business Result in Stock Market Outperformance?

This week, a well-respected colleague put a challenge before me. He said that Trust Across America (TAA) must continue to correlate stock market performance to trustworthiness in order to gain the attention of public companies. In other words, companies care about little else.

While I humbly think that TAA has gained plenty of attention, I love a challenge! So Mike, this one’s for you!

I decided to look back at our first “Top Ten” Most Trustworthy Public Companies named in early 2010 and calculate the collective market performance of these ten companies vs. the S&P 500. We begin our calculation on December 10, 2009, the day the companies were selected, and end on May 17, 2013.

This is the list:

Hess (HES)

Albemarle (ALB)

Best Buy (BBY)

Cummins (CMI)

Eastman Chemical (EMN)

Lexmark (LXK)

Lubrizol (acquired by Warren Buffett)

Sonoco Products (SON)

Texas Instruments (TXN)

USANA (USNA)

Setting Lubrizol aside (although the Buffett acquisition could be the subject of a separate blog post) leaves us with 9 companies. Collectively, these companies posted gains of 63.96% vs. 51.27% for the S&P, resulting in outperformance of 24%. For those of you who want to dig a bit deeper, 8 companies increased their share price while one (Best Buy) saw a decrease. Three companies had greater than 100% stock price appreciation over that period.

So Mike, in the short-term you may be more right than wrong. But the world is not that simple. We are seeing a shift in focus away from shareholder value, albeit a slow one. Building trustworthy organizations and increasing stakeholder trust, while flying in the face of the quarterly income statement mentality, may be gaining in popularity.

I will argue that the companies listed above are “on to something” that somehow approximates trustworthy business practices. On the other hand, maybe Trust Across America just got lucky, as I’m sure some will conclude, when our FACTS® Framework chose these companies back in 2010. You decide.

Feel free to leave your comments here or email me at barbara@trustacrossamerica.com

Our book, Trust Inc:, Strategies for Building Your Company’s Most Valuable Asset is now available for preorder!

Trust Inc.

Albemarle, barbara kimmel, Best Buy, Cummins, Eastman Chemical, FACTS(R), Hess, Lexmark, Lubrizol, Sonoco Products, Texas Instruments, trust across america, trust in business, USANA, Warren Buffett

Recent Comments