We must reinvent a future free of blinders so that we can choose from real options. David Suzuki

Question: What role does trust play as a business imperative when senior executives are unable to remove their blinders?

Answer: No role.

On two separate occasions, I posed the following questions to two senior executives at Fortune 500 companies:

Question #1: How is trust in your organization?

1. Answer from Executive #1: We have no trust issues

2. Answer from Executive #2: We have no trust issues

Question #2: How do you know?

1. Answer from Executive #1: Our revenues are exploding and we are expanding globally.

Note: I call this the “shareholder value” answer.

2. Answer from Executive #2: Weren’t you listening during my speech? Our CSR and philanthropy program is one of the best.

Note: I call this the “corporate window dressing” answer.

Ask almost any C-Suite executive these questions and most likely you will get one of these answers.

Now let’s take a deeper dive

Executive #1 works for one of the largest health insurers in the world. Over 500 employees posted the following comments on Glassdoor.com. Overall, the employees rate the company a 3 out of 5.

- Horrible health benefits (the company is a health insurer)

- Huge cronyism issues

- Tons of corporate politics and red tape

- Poor appraisal process

- High stress

- It paid the bills

- Management by fear

- High turnover rates

Executive #2 works for one of the world’s largest pharmaceutical companies. Let’s see what over 200 employees have to say about their work experience. Overall, the employees rate the company a 3 out of 5.

- We played cards to reduce our workday from 8 to 6 hours

- Employees not allowed to talk to each other

- Too many company meetings and policies

- No decent leadership

- No morale

- Leaders are inept

- Bureaucracy and never ending process

Do these sound like “high trust” companies to you?

The Costs of Low Trust

- Gallup’s research (2013) places 13% percent of workers as engaged (87% disengaged.)

-

The disengaged workforce (Gallup, August, 2013) is costing the US economy $450-550 billion a year, which is over 15% of payroll costs.

- According to The Economist Intelligence Unit (2010), 84% of senior leaders say disengaged employees are considered one of the biggest threats facing their business. However, only 12% of them reported doing anything about this problem.

- According to Edelman globally, 50% of consumers trust businesses, but just 18% trust business leadership.

- And finally, in the United States, the statistics are similar, but the story is a bit worse for leadership. While 50% of U.S. consumers trust businesses, just 15% trust business leadership.

Building a trustworthy business will improve a company’s profitability and organizational sustainability.

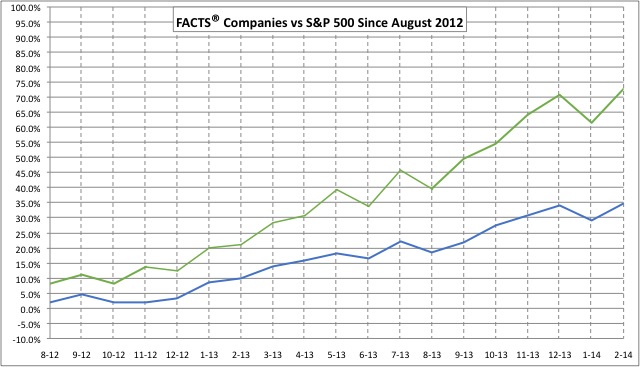

A growing body of evidence shows increasing correlation between trustworthiness and superior financial performance. Over the past decade, a series of qualitative and quantitative studies have built a strong case for senior business leaders to place building trust among ALL stakeholders (not just shareholders) high on their priority list.

According to Fortune’s “100 Best Companies to Work For”, based on Great Place to Work Employee Surveys, best companies experience as much as 50% less turnover and Great Workplaces perform more than 2X better than the general market (Source: Russell Investment Group)

Forbes and GMI Ratings have produced the “Most Trustworthy Companies” list for the past six years. They examine over 8,000 firms traded on U.S. stock exchanges using forensic accounting measures, a more limited definition of trustworthy companies than Trust Across America’s FACTS Framework but still somewhat revealing. The conclusions they draw are:

- “… the cost of capital of the most trustworthy companies is lower …”

- “… outperform their peers over the long run …”

- “… their risk of negative events is minimized …”

From Deutsche Bank:

- 85% concurrence on Greater Performance on Accounting –Based Standards (“… studies reveal these types of company’s consistently outperform their rivals on accounting-based criteria.”)

From Global Alliance for Banking on Values, which compared values-based and sustainable banks to their big-bank rivals and found:

- 7% higher Return on Equity for values-based banks (7.1% ROE compared to 6.6% for big banks).

- 51% higher Return On Assets for sustainable banks (.50% average ROA for sustainable banks compared to big bank earning 0.33%)

These studies are bolstered by analyses from dozens of other respected sources including the American Association of Individual Investors, the Dutch University of Maastricht, Erasmus University, and Harvard Business Review.

Do you think the two companies cited about have trust issues? How can we help them remove their blinders? How can we help them move beyond quarterly numbers and corporate window dressing?

As my friend Bob Vanourek likes to say. “Leaders must place trust on their daily docket.”

Business leaders may choose to ignore the business case for trust but the evidence is mounting, not only for the business case but also the financial one. Trust works.

Barbara Brooks Kimmel is the Executive Director of Trust Across America-Trust Around the World whose mission is to help organizations build trust. She is also the editor of the award winning TRUST INC. book series. In 2012 Barbara was named “One of 25 Women Changing the World” by Good Business International.

Coming Soon!

Should you wish to communicate directly with Barbara, drop her a note at Barbara@trustacrossamerica.com

Copyright © 2014, Next Decade, Inc.

Recent Comments