What stops companies from building a culture of authentic long-term trust? As transparency increases, so does the ability of every citizen to look behind the curtain, with the click of a Google search.

I’m not trying to win a popularity contest with this blog post, at least not with corporate America. But hey, ask most C-Suite folks about trust issues in their organization and they won’t hesitate to emphatically tell you they have not a single one.

Last week I attended an event featuring two guest speakers (also sponsors) from large global companies in different industries. At the end of their respective speeches everyone in the audience applauded loudly except for me, and one other attendee. The other attendee “gets” trust like very few others. Based on their professional credentials, it’s understandable. Think nurse or military leader.

What made these speeches so excruciatingly painful?

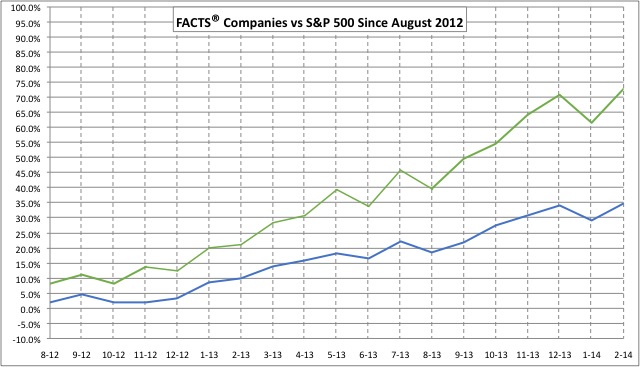

First the canned, compliance-approved content, and second, the cult-like focus on the corporate responsibility programs of both organizations. While Trust Across America’s FACTS® Framework shows us that no company is perfect, both of the sponsor firms have recently paid massive fines for, let’s (politely) say, ethics violations. Not the first fine for either, and probably not the last, and just a mere “blip” on the quarterly earnings radar. So whom are they kidding? Judging from the applause, the vast majority of the audience.

As transparency increases, so does the ability of every citizen to look behind the curtain, with the click of a Google search. All it takes is a few minutes and a curious mind. Corporate responsibility is an important component of a trustworthy organization but it’s only one component. I’m not suggesting that companies air their dirty laundry in public. What I am suggesting is that they stop using the corporate responsibility officer as a public relations pawn. It may work now, but it is a short-term, unsustainable strategy. When the next ethics “oops” occurs, it may be the one that brings down the house, and nobody is going to care about the organization’s philanthropic efforts.

What if the C-Suite were to lead with a culture of trust by creating a long-term trust-building strategy and sent their CR officer into the field to talk about that instead? What if they discussed the company’s values statement or corporate credo, and how it meets the needs of all their stakeholders? What’s stopping companies from building their culture around authentic long-term trust? Is it the legal department?

And finally, the cherry on the weekly “trust cake” is contained in this article in which the author suggests that telling the truth undermines trust.

Next week is the start of spring. It’s also my birthday. Maybe the cake will be a bit less stale. Maybe the most popular flavor will change from artificial vanilla-coating to trust.

For more information on building trust in your organization you can read our new book, Trust Inc., Strategies for Building Your Company’s Most Valuable Asset.

Recent Comments