At Trust Across America-Trust Around the World we remain steadfast in our belief that trust is not a soft skill, nor should it be taken for granted. It is a tangible asset that impacts the bottom line.

Many of our colleagues believe that trust is a top down function, starting at the Board and flowing down through the organization. This means that both the Board and C-Suite must be trustworthy in order for their stakeholders to trust them.

We asked our Trust Alliance members and Top Thought Leaders to weigh in and the following are some “best practices” for elevating trust on both the Board and in the C-Suite.

To earn trust, an enterprise must have a strong corporate character – the unique differentiating identity that expresses its essence. Boards should be focused on – and demand management accountability for – the factors that contribute to corporate character. They include mission, purpose, values, culture, strategy, business model and brand.

Roger Bolton is the president of the Arthur W. Page Society

In order to ensure your corporate viability over time, and to effectively build trust with all stakeholders, it is crucial that strong alignment exists between your business agenda and societal expectations. As captured in the popular line from Fiddler on the Roof, “on the other hand, there is no other hand” – running your enterprise in the face of societal expectations just won’t cut it. Not anymore.

Douglas Conant is the Founder & CEO of Conant Leadership

Just handling problems as they arise isn’t enough. The Conference Board calls for being proactive about business integrity and compliance critical for senior management, and even more so for boards of directors. If we manage corporate integrity based on reacting to problems, by the time we react, the problems are usually very difficult to manage. Being proactive about corporate integrity keeps CEOs and Boards focused on prevention and not cleanup.

Linda Fisher Thornton is CEO of Leading in Context LLC

We’ve all seen the press release. It goes something like this:

“We regret that the actions of a single rogue employee, Mr. BadGuy, were contrary to the values of this company. Our long established principles of integrity, honesty, truth, motherhood, and apple pie have been offended by the scandalous acts of Mr. BadGuy. We condemn the actions of Mr. BadGuy. Mr. BadGuy has left the building.”

In reality, the Rogue Employee excuse serves as an enabler, allowing Boards and CEOs to avoid asking tough questions like “why did our compliance program fail to detect or prevent this misconduct?” and “what failures in our culture and by our management allowed this problem to develop?”

When trouble knocks, compliance-savvy companies should retire the Rogue Employee excuse and instead enquire more deeply within, before others compel them to do so.

Donna Boehme is Principal, Compliance Strategists

Kill the “evening-before” executive team or board dinner. Instead, take a small group of front-line or mid-level employees to dinner in an informal setting, without the presence of other corporate executives. People are forthcoming, thoughtful, and engaging (to say nothing of appreciative).

Sign up for those “Google Alerts” or other independent news alerts to keep abreast of what others are saying or hearing or reading about the organization.

See the entity through the eyes of a new employee, be it via sitting quietly through a live new-employee orientation or its online equivalent.

Robert Galford is a Managing Partner of the Center for Leading Organizations

A company that wants to build trust should listen to the public dialogue about itself and its industry, identify what drives perceptions, and share information throughout the organization to influence decision-making.

What the organization says about itself: The company’s leaders and spokespeople should articulate (authentically) the positive impact their work has on society. In times of crisis they should express empathy and commitment to resolving the situation.

People expect organizations to be savvy about the conversation going on around it. Organizations that are blind to the dialogue, and only communicate outward are unlikely to build and maintain the trust required to be a respected and trusted business in the modern world.

Linda Locke is a Senior Vice President at Standing Partnership.

Boards no longer merely monitor the activities of a CEO and a firm. They can and should lead certain functions for the firm from defining the desired culture to involvement in strategy development. They can be a sounding board for the CEO on the lonely, difficult decisions he or she sometimes faces, especially in a time of crisis. But this mind-flipping attitude change can only be based on the board and CEO viewing each other as trusted allies.

Bob Vanourek is a former public company CEO and the founder of Triple Crown Leadership

Best advice: boards must develop their own robust crisis plans prior to any crisis. They must enumerate what kinds of actions will be taken for different issues: their crisis strategies and philosophies, the speed at which they will work, and who on the board will be designated to play first string, even if — especially if — the Chair or CEO is implicated in some way.

Reputation is becoming one of the top priorities of corporate boards. The best way to protect reputation, and trustworthiness, is to plan before any crisis hits, adjust strategies in real time to fit the specifics of a crisis, and then for the board to execute its plan fearlessly.

Davia Temin is the CEO of Temin & Company

Three prevailing archetypes of board dysfunction: the ego-driven board, the polite surrender board, and the micromanaging board. The protocols for authentic conversation, which require the right conditions for trust to develop, include:

- Sufficient information and understanding to ask the right question.

- A safe space that protects privacy and rejects behaviors to intimidate, ridicule, or insult.

- Enough time to thoroughly explore systemic issues without jumping to conclusions.

The real question is: How long can an organization afford an unproductive board? In a fast changing world, trust is the key to good guidance.

Alain Bolea runs Business Advisors Network

Look for the flavor of “we versus they” in the wording of e-mails. Whenever senior managers are writing to each other about an upcoming BOD meeting or other interface, are the pronouns showing a schism or do they indicate mutual support? When BOD members interact online, does the evidence show a typical frustration, like if only “we” can get “them” to do thus and so.

If you know how to read in between the lines of e-mails, the signs are easily spotted long before a face-to-face meeting. That can lead to corrective action before polarized attitudes are entrenched.

Bob Whipple is CEO of Leadergrow Inc

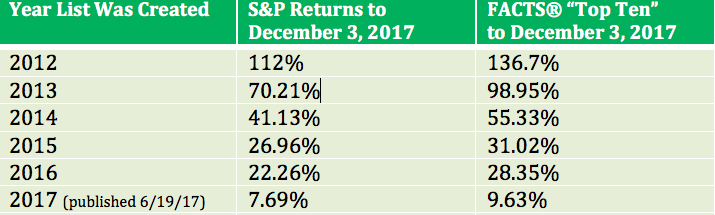

Finally, consider adding some gender diversity to your Board. Our most trustworthy public companies are doing just that, and the results speak for themselves. A closer analysis of our publicly released “Top 10” companies over six years reveals that the average percentage of women on boards is high.

Barbara Kimmel, CEO Trust Across America

Do you have any questions? Please direct them to barbara@trustacrossamerica.com.

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. She also runs the world’s largest global Trust Alliance and is the editor of the award- winning TRUST INC. book series. In 2017 she was named a Fellow of the Governance & Accountability Institute, and in 2012 she was recognized as one of “25 Women who are Changing the World” by Good Business International. She holds a BA in International Affairs from Lafayette College and an MBA from Baruch at the City University of NY.

For more information visit our website at www.trustacrossamerica.com

You may also join our Constant Contact mailing list for updates on our progress.

Copyright (c) 2018, Next Decade, Inc.

Last week the spring issue of TRUST! Magazine was published by Trust Across America-Trust Around the World (TAA-TAW). This special 10th anniversary issue, coauthored with Bob Vanourek, a former corporate CEO and cofounder of Triple Crown Leadership is called Building Trustworthy Organizations: The Role of Good Governance. Having polled almost two dozen lead directors, Board members and governance experts, Bob and I asked three survey questions. The first two were:

Last week the spring issue of TRUST! Magazine was published by Trust Across America-Trust Around the World (TAA-TAW). This special 10th anniversary issue, coauthored with Bob Vanourek, a former corporate CEO and cofounder of Triple Crown Leadership is called Building Trustworthy Organizations: The Role of Good Governance. Having polled almost two dozen lead directors, Board members and governance experts, Bob and I asked three survey questions. The first two were:

Recent Comments