Trust is at the heart of all successful relationships, both personal and professional. While business leaders often view it as a “soft skill” in reality, trust is the key driver of profitability and long-term success. Drawing on the insights of twelve high integrity leaders and thinkers, and in our never-ending quest to elevate trust in business, Trust Across America offers these insights to the most important question for 2017:

What do you believe is the most important action a business leader can take to build trust with his/her stakeholders?

Stephen M.R. Covey, one of America’s most well known thought leaders on trust urges leaders to…

Lead out in extending trust. @StephenMRCovey In building trust with ALL stakeholders, lead out in extending trust. Share on X

Why? Because extending trust generates a reciprocity of trust. When we give it, people receive it—and then they return it. When we withhold it, they withhold it.

Marshall Goldsmith a top American leadership coach seconds Stephen’s advice…

Lead by example. @CoachGoldsmith In building trust with ALL stakeholders, lead by example. Share on X

What we do speaks far more loudly than what we say.

Bob Vanourek of Triple Crown Leadership and a former CEO of five companies, urges leaders to…

Put trust on the agenda. @BobVanourek In building trust with ALL stakeholders, put trust on the agenda. Share on X

By constantly putting trust questions on the agenda, like “Are we building trust with what we are doing here?” everyone will begin to understand and take action on building trust.

David Reiling, Sunrise Bank’s CEO suggest that leaders…

Walk the talk. @ReilingDavid In building trust with ALL stakeholders, walk the talk. Share on X

Day-in and day-out, night-in and night-out, weekends and holidays. Being authentic and living with integrity builds trust in business and everywhere else.

Linda Fisher Thornton who runs Leading in Context and is on a mission to unleash the positive power of ethical leadership urges leaders to…

Show genuine interest. @leadingincontxt In building trust with ALL stakeholders, show genuine interest. Share on X

Initiate conversations and find ways to add value. Think about the impact of every decision on every stakeholder, and act in their best interests as well as your own.

Tim Erblich, CEO of Ethisphere believes the most important action a leader can take to build trust is to…

Measure the culture @TimErblich In building trust with ALL stakeholders, measure the culture. Share on X

of his/her business, and openly share the findings with employees, stakeholders and more.

Dave Ulrich, a professor at the Ross School of Business (University of Michigan) and co-founder of the RBL Group, found it hard to pick one thing so we picked it for him!

Be transparent. @Dave_Ulrich In building trust with ALL stakeholders, be transparent. Share on X

Avoid leadership hypocrisy…do what you say. Share personal feelings.

Evan Harvey who directs Corporate Responsibility at NASDAQ seconded the theme of transparency with his answer…

Act transparently. @EvanHarvey99 In building trust will ALL stakeholders, act transparently. Share on X

Tell your stakeholders what you are trying to accomplish and why; then demonstrate progress towards a goal. That involves others in the process, widens the circle of influence and interaction, and builds lasting trust.

Jim Lukaszewski, an author, speaker and crisis management consultant urges leaders to…

Be candid. @JimLukaszewski In building trust with ALL stakeholders, be candid. Share on X

Find the truth, tell that truth, act on it promptly in an environment where values matter at least as much as profits and gain. Candor: truth with an attitude told right now is the basic building block of Trust.

Doug Conant, former CEO Campbell Soup who heads Conant Leadership, believes the most important action a business leader can take to build trust is…

Do what you say you are going to do. @DougConant In building trust with ALL stakeholders, do what you say you are going to do. Share on X

And do it well. How can people trust a leader who says one thing but does another? They can’t and won’t.”

Jason Lunday Principal Consultant Integrity Factor quotes another one of my favorite trust thought leaders, Frank Navran “Trust is the result of promises fulfilled.”

Keep your promises. @Jason_Lunday In building trust with ALL stakeholders, keep your promises. Share on X

Establish full-cycle mechanisms to ensure that the organizations’ promises will be met, including communicating success.

And as the 12th recommendation Barbara Kimmel (that’s me) offers leaders the following:

The leader sets the tone for the organization. @BarbaraKimmel In building trust with ALL stakeholders, the leader sets the tone for the organization. Share on X

Building stakeholder trust first begins with leadership recognition that trust is critical to long-term organizational success. This means making trust a leading business focus in both the Board & C-Suite, reinforcing the trust imperative, and always leading by example.

Thank you to all our contributors. May 2017 bring increasing stakeholder trust to your organization!

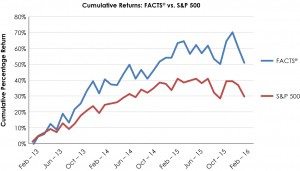

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. Now in its seventh year, the program’s proprietary FACTS® Framework ranks and measures the trustworthiness of over 2,000 U.S. public companies on five quantitative indicators of trust. Barbara is also the editor of the award-winning TRUST INC. book series and a Managing Member at FACTS® Asset Management, a New Jersey registered investment advisor.

Copyright (c) 2016, Next Decade, Inc.

Recent Comments