A customer service representative at a major health insurance company recently told me that HIPAA prevented him from disclosing whether an application submitted for one of my children had been received by the company. I sensed he had misinterpreted HIPAA whose purpose is to safeguard medical information, but as he insisted, he was just “following the rules.” I thanked him for his time, hung up, and called back to the same department. The second customer service rep gave me the information I needed without hesitation.

Whether an employee or a customer, I’ll bet you’ve heard these statements (excuses) or used them yourself more than once.

- I need to get approval to do (or say) that.

- I need to clear this through compliance.

- I need permission before you can quote me.

- I can’t help you without approval.

- I’m just following the rules.

- I apologize for your frustration.

Perhaps it’s time for business leaders to take a few minutes to understand the relationship between trust and approval.

Merriam-Webster provides the following definitions of approval:

Definition #1: The belief that something or someone is good or acceptable: a good opinion of someone or something.

Definition #2: Permission to do something: acceptance of an idea, action, plan, etc.

Focusing now on Definition #2, how many employees are constrained by “permission” in your organization? Have you considered how this impacts:

- Speed of innovation

- Decision-making

- Employee engagement

- Cost

Every time an employee needs approval to say or do something, the “approval” process impedes the outcome. In fact, the process may be so daunting, that employees choose to take the “easy” road, never creating anything new or suggesting a novel idea; or as in the story above, checking with someone else when they clearly do not understand the company’s daunting “rules.”

As a business leader, have you considered how your customers are impacted by the “approval process” in your organization, or how the company’s actions:

- Waste customer AND employee time

- Create hard feelings

- Lower customer retention

- Damage reputation and elevate risk

- Raise costs

As a business leader, what if your focus shifted from “approval” or rule enforcement to elevating stakeholder trust?

The most progressive and successful CEOs and their Boards have redirected their attention to crafting long-term vision and values statements and/or Codes of Conduct, not driven by legal and compliance, but by their two most important stakeholders, their employees and their customers. (The “credo” etched into the wall at corporate headquarters does not even begin to satisfy this requirement.) The entire staff, beginning with the Board and CEO, must vow to live their values every day, and ensure that employees understand that any “values violation” will result in immediate termination. Just imagine the innovation, speed of decision-making and empowerment that would result from this cultural transformation, not to mention the ultimate cost savings and impact on profitability.

During the editing process of our book Trust Inc. I reviewed the websites of many large public companies with the goal of including an Appendix brimming over with examples of well-crafted vision statements. This became a difficult and disappointing task as the handful identified could not be included in the book without “approval” from the respective company’s legal department, which would have meant a lengthy delay of the book’s publication. Instead, I created a “work around” by eliminating the company name. What a lost opportunity for all!

If organizations spent more time building values instead of layers of legal teams and compliance departments, the word “approval” would start to look more like Merriam-Webster’s first definition:

The belief that something or someone is good or acceptable: a good opinion of someone or something.

And “approval” would be replaced with trust.

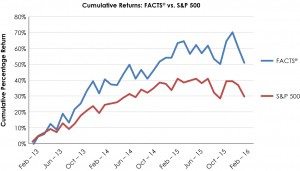

The most progressive business leaders have joined our Trust Alliance to ensure that they never miss an opportunity to learn about elevating organizational trust.

Barbara Brooks Kimmel is the CEO and Cofounder of Trust Across America-Trust Around the World whose mission is to help organizations build trust. She also runs the world’s largest global Trust Alliance and is the editor of the award- winning TRUST INC. book series. In 2017 she was named a Fellow of the Governance & Accountability Institute, and in 2012 she was recognized as one of “25 Women who are Changing the World” by Good Business International. She holds a BA in International Affairs from Lafayette College and an MBA from Baruch at the City University of NY.

For more information visit our website at www.trustacrossamerica.com or contact Barbara Brooks Kimmel, CEO and Cofounder

Barbara@trustacrossamerica.com

You may also join our Constant Contact mailing list for updates on our progress.

Purchase our books at this link

Copyright 2017, Next Decade, Inc.

Recent Comments